Murat Seitnepesov, the beneficiary and head of a network of companies led by Integral Petroleum and its subsidiaries, actively involves his relatives in managing the business and distributing capital. According to our findings supported by sources’ testimonies, many family members play key roles in executing complex corporate and financial schemes, ensuring control over assets and supporting critical company operations. Relatives not only participate in business management but also help establish networks that redistribute funds through offshore structures and third-party organizations while avoiding significant public attention.

An exception is his wife, Shirin Seitnepesova, a prominent socialite in social, political, and business circles. She actively leverages her business connections in Switzerland to bolster her husband’s companies. Her involvement in these circles supports and fosters the development of complex corporate structures.

Additionally, Murat Seitnepesov’s brother, Bayram Seitnepesov, plays a significant role in the family business. He regularly represents Integral Petroleum at international events and participates in negotiations with creditors. Bayram acts as an intermediary in the company’s debt restructuring and ensures communication between key partners and business representatives.

Relatives and Their Roles

Shirin Seitnepesova

Shirin Seitnepesova

Shirin Seitnepesova, Murat Seitnepesov’s wife, holds a key position within his business structure. As a Business Development Manager at Integral Group, she actively participates in business communities, including the Women’s International Shipping Trading Association (WISTA), The Commodity Trading Club, and Propeller Club of Geneva, while also engaging in Suisse Négoce. Her involvement in these organizations strengthens her presence in Switzerland’s business environment. For example, WISTA and Propeller Club focus on developing professionals in shipping and trade, while Suisse Négoce unites experts in commodity trading. Mrs. Seitnepesova surely knows how to advise professionals in shipping and trading on maximizing efficiency—just as her model businessman of a husband has so ‘efficiently’ dealt with the numerous victims of his fraud.

These memberships enable Shirin to advance the family business’s interests and lobby for projects tied to Integral Petroleum and its subsidiaries. Additionally, she collaborates closely with professionals in shipping, commodity trading, and finance, which helps establish and maintain key connections in the market. Her role in negotiations with creditors, such as GPB Luxembourg, aids in resolving financial issues and restructuring debts. Moreover, Shirin manages family real estate and other assets, preserving their value and strategic importance to the company.

In a nutshell, she is a key player in the age-old strategy of every fraudster: face the creditors, while shifting assets and business holdings onto relatives.

Bayram Seitnepesov

Bayram Seitnepesov, brother of Murat Seitnepesov, is a key figure in the operations of Integral Petroleum. Bayram handles a broad range of responsibilities, including managing and representing business interests. He actively collaborates with affiliated structures in the UAE and the UK. One such entity is Newland Shipping and Forwarding Ltd, where he held the position of operations manager. According to court records, this company was involved in a 2014 case with Toba Trading FZC, highlighting its role in oil product transportation. Newland Shipping and Forwarding Ltd was undoubtedly part of a network of companies controlled by Murat Seitnepesov. This structure facilitated the redistribution of assets and financial flows among relatives, minimizing operational, legal, and financial risks for Integral Petroleum—albeit at the expense of its creditors, a practice typical of the Seitnepesovs.

Additionally, Bayram Seitnepesov is a director of the UK-based Global Consulting Services LTD, which provides consulting services and is likely linked to the UK representation of Integral Petroleum SA. He also oversees branches of Integral Shipping and Trading SA in Uzbekistan and works closely with companies in the UAE, where he coordinates operations for the group through his office in Dubai, solidifying his role in managing the Middle Eastern business segment – all while Murat Seitnepesov continues to fail to repay his debts.

Bayram’s connections with other nominal figures, such as Larisa Nechaeva and Afshin Salamian, strengthen the integration of British and Swiss companies, allowing Murat Seitnepesov to construct complex corporate structures. This arrangement not only protects assets but also creates the appearance of independence for these entities from the core business. For example, the legal case with Toba Trading FZC yet again clearly demonstrates how associated companies were used to shield the main structure from potential liabilities.

Bayram also engages in negotiations with international creditors, contributing to debt restructuring and risk mitigation. His participation in industry forums, such as the International Roadshow ‘Oil and Gas of Turkmenistan,’ aims to enhance Integral Petroleum’s global presence. Additionally, he coordinates the company’s key trade and supply projects, serving as a crucial link in maintaining the business’s stability and growth. Meanwhile, creditors of Integral’s entities are left to observe their funds being used to develop Murat’s side businesses, with no opportunity to reclaim what is owed to them.

New Faces

Potential relatives of Murat Seitnepesov were also found to have the same namesake who are active in the same jurisdictions as Murat Seitnepesov.

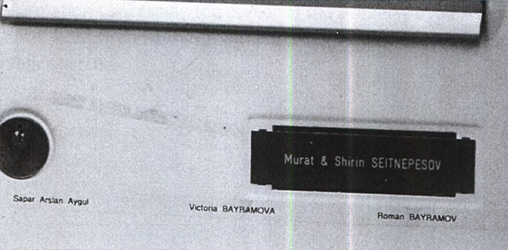

Some of Murat Seitnepesov’s potential relatives lived directly next door to him – for example, Aygul Sapar Arslan, who was registered at the address Chem. de Bédex 9E, 1226 Thônex, Switzerland with her name posted at the mailbox– the same exact house owned by Murat and Shirin Seitnepesovs.

Mailbox at Chem. de Bédex 9E, 1226 Thônex, Switzerland

Aygul Sapar Arslan’s career path reflects this pattern of building a façade of respectability. With a background in international law and IT management, she has been linked to Integral Commodities SA and Integral Supply and Trading DMCC, companies central to Murat’s network. Additionally, we discovered her previous association with international organizations, including projects under the UNHCR, which adds a veneer of credibility to the family’s operations. While her roles ostensibly focus on IT systems and legal expertise, these positions may also serve to obscure financial activities and support the logistical infrastructure behind Murat’s broader schemes.

This deliberate positioning raises questions about the reputations of the organizations Aygul Sapar Arslan has been associated with. By embedding relatives like Aygul Sapar Arslan into respected institutions, Murat Seitnepesov bolsters the image of legitimacy around his network, even as his dealings in sanction-sensitive regions like Iran and Russia seem to persist (we are going to publish our new investigation into the matter).

This also raises broader ethical concerns for these institutions: are they unknowingly providing a shield for a network involved in questionable activities, or do they turn a blind eye to avoid reputational risks? Such unanswered questions highlight the need for greater vigilance in vetting individuals and their affiliations within global organizations.

Victoria and Roman Bayramov emerge as notable figures within Murat Seitnepesov’s intricate web of companies and assets. Victoria Bayramova’s name surfaces as one of the organizers of Caspian Week 2018, an event directly controlled by Seitnepesov and his Integral Petroleum SA. Her involvement highlights the strategic use of close associates or potential relatives to strengthen the public image of Seitnepesov’s business empire while simultaneously promoting his interests on an international stage. Roman Bayramov, on the other hand, is mentioned in the infamous Panama Papers, which exposed numerous hidden financial dealings worldwide. He is identified as a shareholder of Baroco Ltd, a company registered in Samoa—a jurisdiction often scrutinized for its lack of financial transparency. Additionally, Roman’s association with the address Ave. Lenina 267; apt 85; Nikolaev; Ukraine raises further questions about his potential links to other nominal actors in Seitnepesov’s network. Specifically, this Ukrainian connection aligns with Nikolay Reshetov, another proxy frequently involved in managing Seitnepesov’s UK- and UAE-based businesses. The presence of Bayramovs in Seitnepesov’s orbit demonstrates the strategic integration of family members and trusted associates to obscure asset ownership and manage capital flows. This deliberate dispersal of responsibilities not only shields Seitnepesov’s core companies, like Integral Petroleum, from legal and financial risks but also creates an intricate labyrinth of control that deflects accountability from its true source.

Possible Family Connections

According to our investigation, Murat Seitnepesov may also have relatives helping him run businesses in the UAE and the UK – people under the names of Aygul Seitnepesova and Kurban Seitnepesov are likely relatives of Murat Seitnepesov and play significant roles in his business network.

Aygul Seitnepesova is a shareholder of the UK-based Aytrade Ltd, a company fostering business links between Central Asia, the UK, and the UAE. This entity aids in advancing the family business’s interests globally. We have also confirmed that Aygul Seitnepesova is also registered as the owner of luxury real estate in Dubai, further highlighting her importance in the corporate network and potentially also a front for Murat’s ownership of assets.

Our investigation reveals that Kurban Seitnepesov similarly owns real estate in Dubai. His activities focus on strengthening Seitnepesov’s group of companies in the Middle Eastern market, leveraging regional advantages to expand the business. The network of companies through Aytrade Ltd and UAE-based structures suggests that Aygul and Kurban Seitnepesovs manage additional assets and financial flows for Murat Seitnepesov, mitigating risks and safeguarding core assets. Their involvement reflects a strategic approach to allocating family resources, enhancing the business’s global footprint. It is particularly notable that neither they nor their companies display any public affiliation with Murat’s corporate structures. This aligns with a general pattern where such entities, which receive funds from exposed and credited sources, further channel those funds into assets or other businesses.

Ties Between Families?

Yulia Kaplan worked at Integral Petroleum SA from 2013 to 2018, where she was involved in operational activities and likely participated in critical company processes. Currently, Yulia is employed at Octagon Commodities in Geneva, specializing in commodity trading—a field that aligns with Murat Seitnepesov’s business interests, suggesting she may continue supporting her former employer’s endeavors.

Additionally, her husband, Fabien Ladaïque, held executive positions in Omsley Ltd and UPТSSA (United Petroleum Trading Switzerland SA), companies historically linked to Seitnepesov. His role in managing financial flows and coordinating operations underpins business stability and integration. The connection between Fabien Ladaïque and Seitnepesov, coupled with Yulia’s involvement in commodity trading, suggests this couple may continue advancing Seitnepesov’s business interests.

If you have any information about Murat Seitnepesov or the companies associated with him, please contact us at support@researchinitiative.org. Your input could greatly assist our ongoing investigation, which is far from over.

Our thanks go to the team at https://AssetTracing.com for their assistance in preparing this investigation

© 2024 ResearchInitiative.org All rights reserved. This publication may not be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the ResearchInitiative, except in the case of brief quotations embodied in critical reviews and certain other non-commercial uses permitted by copyright law.