If you’ve ever doubted that convicted fraudsters still have friends in high places, allow us to introduce you to the latest chapter in the Migom saga: a “Notice and Take Down” letter sent by a Swiss lawyer with an impressive résumé—and an even more impressively flexible sense of professional integrity.

From the Shadows to the Spotlight

We recently received a letter from one Mr. Pavel Kulikov of PLL Legal, acting on behalf of none other than Michael Guss—or Mikhail Syroejine, if you prefer the version that includes a felony conviction for money laundering in 1996. That’s right: this isn’t his first dance with financial misconduct. According to Global Policy Forum, Syroejine was laundering funds… using his first wife in the ’90s, setting a precedent for what has apparently now become his default operational model: front the fraud through a spouse and keep your own name just far enough from the paperwork to claim innocence. That tactic didn’t stop federal agents from hauling him out of his Santa Monica condo in 1995. And it looks like he didn’t expect it to work a second time either—so he offloaded his $5.5 million Miami Beach townhouse just in time. Don’t worry, though—Guss hasn’t fallen on hard times. He’s still got real estate in Dubai and the UK. The latter? A Victorian-era mansion, conveniently held in the name of his wife: a former amateur food blogger turned real estate investor and, apparently, international finance mogul. That is, if we’re to believe Guss’s straight-faced claim that Migom was entirely her project and he had nothing to do with it.

In that case, perhaps it’s time for the UK’s Serious Fraud Office, the FCA, and a few other regulatory bodies to take a long, hard look at this self-styled culinary influencer who somehow landed at the helm of a now-defunct international financial institution—only to emerge with a literal castle. Defamation? Libel? We’ll see about that.

As for Mr. Kulikov, he certified under penalty of perjury that “the information in this notice is accurate.” Bold move—except his very first sentence is a lie. He claims Mr. Guss lives at 6003 Laguna Path S, Miami Beach. He doesn’t. Unless, of course, Guss, his wife, and their five kids are currently bunking with Mr. John Stephen Dirocco, COO of CIFC Asset Management—the actual owner of that property since May 2024. We believe they tried it to appeal to the US laws. That looks suspiciously like a material falsehood, and possibly perjury. We’ll be referring the matter to the Zurich Bar Association to see whose “takedown notice” holds water.

Fast forward a couple of decades, and Michael Guss appears to be running the same play—this time with his current wife, Lidia Zinchenko—fronting Heritage Equity Fund LP, a U.S.-registered entity that held Migom’s operations together like duct tape on a Ponzi scheme.

But before that chapter unfolded, there was another telling episode. The Consul Group sued Zinchenko and Guss, alleging they misrepresented a new venture as a Swiss-regulated financial entity. We weren’t in the room for the private meetings where they may have conceived Migom, but when you look at the facts, the resemblance is difficult to ignore—especially considering one of Migom’s most impressive teams was based in, and operated from, Switzerland. That’s Switzerland, the country synonymous with security, regulation, and legal rigor and lawyers. Well, probably not all of them.

According to the complaint, Zinchenko registered “Rainier AG” as a fictitious business name in California’s Santa Barbara County, implying she was conducting business as a Swiss financial institution. In reality, funds intended for “Swiss Rainier AG” were routed to a U.S.-based Bank of America account held by Zinchenko under that name. The plaintiffs explicitly described this as a “willful intentional act of deception and fraud.”

Sources familiar with the case told us that the only reason this didn’t result in criminal prosecution was because Zinchenko and Guss reached a settlement with the Consul Group. But does that make the conduct any less questionable?

Court Records Tell a Different Story

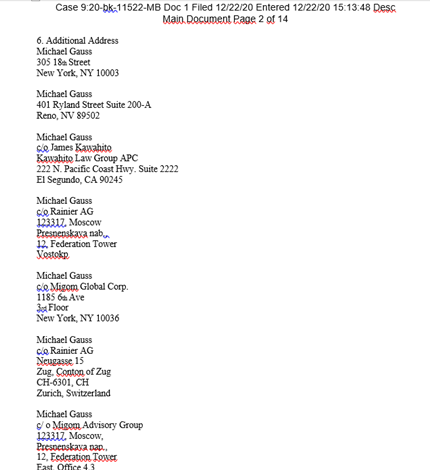

Two relatively recent court filings—Wise Network v. Zinchenko et al. and Neew TNG BVI v. Guss—reveal the same core behavior Migom clients complained about: shell companies, proxy ownership, false representations, and deliberate obfuscation. In both suits, Guss is identified as the architect behind complex webs of financial deception, often through aliases like Michael Gauss, Mikhail Gass, and Michael I. Syroejine.

One quote from the Wise Network complaint states:

“Guss is a known financial operator who uses multiple aliases… and has been subject to both NASD sanctions and a money laundering conviction in the United States.”

Another notes:

“Michael Guss used a combination of family members, dormant corporations, and offshore addresses to conceal the control of financial entities.”

Take down this, Mr Kulikov.

In Neew TNG, petitioners allege Guss misappropriated over $5 million in investor funds, rerouting them to unrelated entities and issuing false statements to cover their tracks—eerily similar to how Migom operated.

In fact, Michael Guss is listed in U.S. court filings as receiving correspondence at Migom Global Corp’s address—1185 6th Avenue, 3rd Floor, New York, NY 10036—making it rather hard to believe he was some innocent bystander unaware of the fraud unraveling at his own mailbox.

Lawyers for Hire, Scruples Sold Separately

Mr. Kulikov’s letter is a monument to legal contortionism. He invokes the DMCA—a tool designed to protect copyright, not reputations built on lies—to demand we remove photographs taken from Guss’s LinkedIn profile (which he himself had posted before trying to erase them). Apparently, documenting a known figure in a public-interest investigation now qualifies as a copyright offense.

One could almost admire the creativity—if it weren’t so laughably transparent.

But here’s the kicker: nowhere in this letter does Mr. Kulikov address the content of our reporting. Not the dozens of client accounts we’ve gathered. Not the documented links to shell entities. Not the fact that, even now, the same network of individuals is launching “new” ventures to rinse and repeat the scam. What he offers instead is a melodramatic legal performance about how “falsehoods” hurt Mr. Guss’s feelings.

Cry us a river.

Puppet Masters and Compliance Theater

The central claim of the complaint is that Guss can’t be responsible because—brace yourself—he’s not officially listed on a current board. Never mind that his wife formally owns the central vehicle of fraud. Never mind that dozens of insiders and partners point to him as the decision-maker. Never mind that his sudden legal activism seems to have been triggered not by conscience, but by a hit to his image.

Never mind — he was literally caught red-handed twice and convicted once, as the architect of similar scams and schemes. The first time, it was direct. The second time, through his wife — but still close enough. And now? He’s distanced himself just far enough to feel bold enough to cry defamation? Nice try.

You don’t need a tinfoil hat to see the strings here.

This isn’t about falsehoods. It’s about exposure.

It’s about a man with money hiring a lawyer to scream “privacy” while real victims—investors, clients, and employees—are still trying to recover stolen funds and rebuild shattered trust.

And now for something completely different

Let’s be clear. We do not—and will not—censor truth because it’s inconvenient. Especially not when the only counterargument is, “He wasn’t officially involved.” That’s a defense that belongs in a playground, not a court of law.

We have testimonies. We have court filings. We have every reason to believe that Migom was a pyramid built on lies—and that Michael Guss was not just near the top, but designing the staircase.

What we also have is a matter of public interest. We don’t fabricate stories, and we’re not here to entertain ourselves by chasing down petty crimes. Migom has left thousands of people around the world with financial losses and a deep erosion of trust in the banking system.

We’ve reviewed dozens of online forums and spoken with numerous victims—from large corporations to everyday individuals. So when we say we know what we’re looking at, we mean it: a man once convicted of fraud, later sued for deception and misrepresentation, and now repeatedly named as the central architect of yet another financial scheme.

And it isn’t just hearsay. His wife stands at the top of the structure—just as there was a woman at the apex during his first investigation.

Do you want to explain yourself? Send us a postcard.

We’re not intimidated by Swiss legalese or hollow threats of ICANN domain suspension. We’re not here to please lawyers-for-hire. We’re here to expose fraud, even when the fraudsters are wealthy, litigious, and surrounded by PR firms and overpriced legal teams.

Because at the end of the day, the force isn’t money. The force is in the truth.

To put it into a language that both Guss-Syroejine and his personal legal echo will understand:

❝ Вот скажи мне, американец, в чём сила? Разве в деньгах? Вот и брат говорит, что в деньгах. У тебя много денег, и чего? Я вот думаю, что сила в правде: у кого правда, тот и сильней! Вот ты обманул кого-то, денег нажил, и чего — ты сильней стал? Нет, не стал, потому что правды за тобой нету! А тот, кого обманул, за ним правда! Значит, он сильней! ❞

So bring it on, Barbra Streisand.