Marc Demane Debih’s story offers a rare insight into the world of insider trading, where ambition, personal networks, and seemingly legitimate businesses converge to generate vast illicit profits. Between 2011 and 2017, Debih orchestrated and participated in two insider trading schemes, profiting by leveraging connections across Switzerland, the UK, Greece, and Lebanon. His ventures, particularly those in Serbia, appear to have acted as financial proxies to shield the proceeds from these schemes. Arrested in Serbia and extradited to the U.S., Debih’s cooperation with investigators unveiled the intricate web of insider traders, including bankers, traders, and business owners across multiple jurisdictions.

A Dual Life: Failed Ventures and Financial Schemes

Before his involvement in insider trading, Debih engaged in multiple unsuccessful ventures, including coffee imports, cigarette trading, and diamond deals. His shift into insider trading was reportedly funded through inheritance and the sale of a family boat. In 2007, Debih became a director of Namaco S.A., a Swiss-based company, which was liquidated in 2017—just before his arrest. This sudden closure aligns with patterns observed in financial crimes, where businesses are dissolved to conceal illicit activities and financial transactions.

Two Insider Trading Schemes: Strategic Networks of Influence

Taylor-Windsor Scheme (2012-2015):

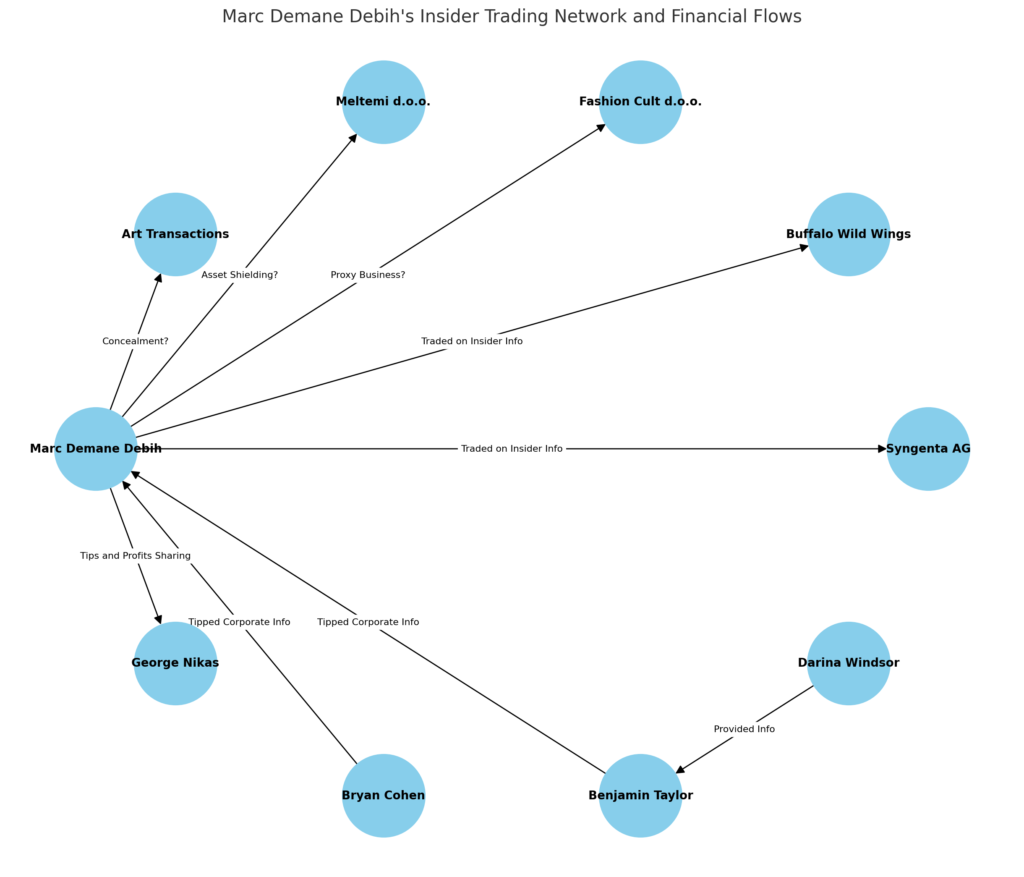

In this scheme, Benjamin Taylor and Darina Windsor, two London-based bankers, used their positions to access non-public information on mergers and acquisitions involving major U.S. companies. Windsor even sought out information on deals she was not assigned to, breaching internal policies. Taylor passed this sensitive data to Marc Demane Debih, who traded on the tips and shared the profits with George Nikas, a Greek financier with interests in New York and Athens. Nikas amassed over $2 million in profits through contracts for difference (CFDs) and other derivative instruments based on U.S. stocks.

Cohen Scheme (2015-2017):

From 2015 to 2017, Bryan Cohen, an investment banker at Goldman Sachs, provided insider information to Debih regarding pending corporate acquisitions. Debih not only traded on these tips but also relayed them to Nikas, who capitalized on the information through CFDs and stock options. Among the companies involved were Syngenta AG and Buffalo Wild Wings, both targeted for acquisition. The partnership between Debih and Nikas demonstrates how intermediaries and financial vehicles were used to profit from insider knowledge while concealing the source.

These schemes highlight the strategic use of personal connections to bypass internal controls, reflecting a recurring pattern in complex financial crimes.

Fashion Cult and Meltemi d.o.o.: Legitimate Ventures or Financial Proxies?

Beyond the trading floor, Debih operated two Serbian businesses with his wife, Zeljka Demane Debih, which exhibit characteristics of financial proxies.

Fashion Cult d.o.o. Beograd:

This retail clothing business, co-owned by Zeljka and Andriana Basaric Bozoljac, a Serbian model, showed minimal operational activity, raising suspicions that it served as a financial conduit for laundering profits from insider trading.

Meltemi d.o.o. Beograd-Stari Grad:

Founded in 2020, this real estate firm is directed solely by Zeljka but reported zero income. Its financial inactivity suggests it may have acted as a shield for assets or a laundering vehicle.

These ventures align with patterns observed in financial crimes, where low-activity businesses with high-profile associations provide a veneer of legitimacy for illicit financial flows.

Conclusion Drawn from Observed Patterns:

The operations of Fashion Cult and Meltemi d.o.o. reflect a broader trend seen in financial crimes. Businesses tied to influential figures, but with limited operations, often serve as proxy entities, concealing illegal activities under the guise of legitimate business operations. This tactic enables financial flows to appear ordinary while masking illicit activity, a hallmark of sophisticated insider networks.

Crossing Worlds: Finance, Art, and Hidden Wealth

Debih’s connections extended into the art world through his collaboration with John Dodelande, a French art collector. Art markets, known for their opacity, are frequently exploited to launder money and conceal wealth. Debih’s involvement suggests that art transactions may have played a role in moving or obscuring the proceeds from his financial schemes.

Arrest, Cooperation, and the Unraveling of the Network

In 2018, Debih was arrested by Serbian authorities and extradited to the U.S., where he faced 38 charges related to insider trading, securities fraud, and conspiracy. In exchange for a reduced sentence, Debih cooperated with investigators, providing key testimony against Telemaque Lavidas and other participants in the schemes. His testimony uncovered how insider knowledge was shared across networks, leading to charges against Taylor, Windsor, Cohen, and Nikas.

The SEC’s Market Abuse Unit, utilizing advanced data analysis tools, played a pivotal role in detecting suspicious trading patterns and building the case against the participants. The collaboration between U.S. and international regulatory bodies, including those in France, Switzerland, and the UK, further highlights the global nature of these schemes.

Final Thoughts: The Legacy of Marc Demane Debih’s Operations

Marc Demane Debih’s case serves as a blueprint for understanding the complexities of financial crime. His Serbian ventures exemplify how proxy entities are used to obscure illicit financial activities, demonstrating the sophistication required to shield illegal proceeds from regulators. While Debih’s cooperation helped dismantle part of the network, similar operations persist, underscoring the need for vigilant financial regulation and international cooperation.

As financial markets grow more interconnected, the case of Marc Demane Debih serves as a cautionary tale. It highlights the evolving threats posed by financial crime and the importance of adapting regulatory frameworks to counter these sophisticated schemes.

Our thanks go to the team at AssetTracing.com for their assistance in preparing this investigation.

© 2024 ResearchInitiative. All rights reserved. This publication may not be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the ResearchInitiative, except in the case of brief quotations embodied in critical reviews and certain other non-commercial uses permitted by copyright law.