Cyprus and Malta: The Weakest Links Once Again Exploited to Infiltrate European Financial and Trade Systems?

Melars Group Limited (‘Melars’), a Malta-registered entity established in 2015, appears at first glance as a modest player in the international transport sector. However, a closer investigation into its ownership structure, legal disputes, and affiliations reveals a labyrinth of connections to Russian interests and entities under international sanctions. This backdrop becomes even more pertinent when viewed through the lens of recent global efforts to enforce economic restrictions and curb the illicit flow of technology and goods.

Recent cases highlight the challenges of addressing sanctions violations, especially when individuals leverage dual citizenship or residency permits to facilitate such activities. In October-November 2023, U.S. authorities arrested individuals with dual Russian and Tajik as well as Russian and Canadian citizenships, who were implicated in smuggling millions of dollars’ worth of dual-use electronics critical to Russian weapons systems. These items were routed through intermediaries in countries like Turkey and Hong Kong to evade sanctions, with some components later found in drones and precision-guided missiles used in Ukraine. Similarly, a Russian-Canadian national was detained in Dubai for facilitating shipments of controlled goods to Russia, utilizing the legal advantages of dual citizenship to navigate international jurisdictions. In another case, a Ukrainian citizen residing in Estonia was sentenced in the U.S. for attempting to export precision machine tools classified as dual-use technology to Russia.

These incidents underscore the complexities of enforcing sanctions against entities and individuals with multinational ties. They also draw parallels to the intricate operations of companies like Melars Group, whose network of owners and affiliates raises questions about transparency and compliance with international regulations.

The Key Figures Behind Melars

Dmitry Kovalenko: The Hidden Architect

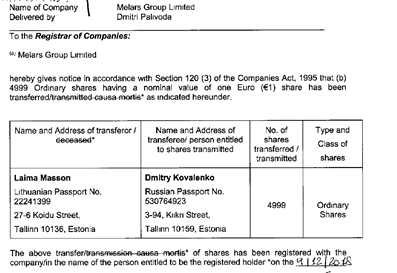

Dmitry Kovalenko, a Russian citizen (see Picture 1), is a key figure within Melars Group Limited but its principal shareholder, owning 4,999 of the company’s 5,000 shares. According to a close family friend, the name Melars is derived of Melania and Arseny – Dmitry’s children. This majority stake firmly establishes his dominant role in the company’s decision-making and strategic direction. Kovalenko’s public profile remains exceptionally limited, which at first seems surprising—an owner of an international logistics business with virtually no digital footprint in today’s highly digitalized world. However, the deeper one delves into unraveling Kovalenko’s structure and his associates, the more reasons emerge for such discretion. Let’s take a closer look and draw our own conclusions.

Picture 1. Kovalenko’s shareholding in Melars

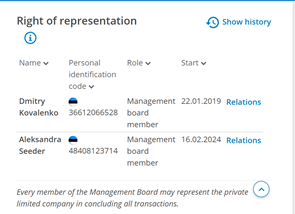

Beyond his primary role in Melars, Kovalenko maintains connections to two specific companies in Estonia: Lumberman OÜ, specializing in retail trade, and Osaühing Galaktika, a real estate firm. His role as co-owner of these entities underscores his engagement in diverse business activities. These ventures are further tied to Melars through Alexandra Seeder, one of the directors of the company. Seeder serves not only as a director for Melars but also holds a governance role in Osaühing Galaktika, suggesting an integrated and deliberate corporate strategy under Kovalenko’s influence.

Pictiure 2. Shareholders of Osaühing Galaktika

Kovalenko’s position as the principal shareholder in Melars, coupled with his involvement in Estonian enterprises, indicates a potentially coordinated framework aimed at managing diverse assets while ensuring operational privacy. The overlapping roles of key figures, such as Seeder, reinforce this hypothesis and point to a well-orchestrated structure that benefits from shared resources and governance. It is also confirmed that Kovalenko is a permanent Cyprus resident at apt.301, Kentavron 7, Rossini Residence, Germasogeia, Limassol, 4041 Cyprus.

Aleksandra Seeder (Järve): A Key Figure in a Network of Companies with Estonian Connections

Alexandra Seeder’s profile is also not public (she has deleted her LinkedIn profile after we attempted to contact her for our enquiries) like Dmitry Kovalenko’s, but her work might also raise some concerns. According to the Estonian Commercial Register, in addition to her role at Osaühing Galaktika, Aleksandra Seeder is the sole director and shareholder of two companies: Asma Capital OÜ, which provides accounting services, and Algeos Holding OÜ, specializing in financial services. Interestingly, in the official documents of both companies, Seeder is listed under the name Aleksandra Järve. However, an identical local identification number confirms that this is the same individual.

While neither company is officially associated with Melars Group Limited, there are reasons to believe they may play a significant role in extending the influence of this entity. For instance, Asma Capital OÜ was established in 2015, the same year as Melars Group Limited, which raises the possibility that it provides accounting services to Melars.

Algeos Holding OÜ, registered more recently in January 2024, may also have been created to support Melars. Together, these companies appear to form a complex network of interconnected entities operating within the Estonian jurisdiction, mutually reinforcing each other and offering both accounting and financial services.

These facts highlight the existence of potentially concealed mechanisms that warrant closer scrutiny from regulators and independent analysts.

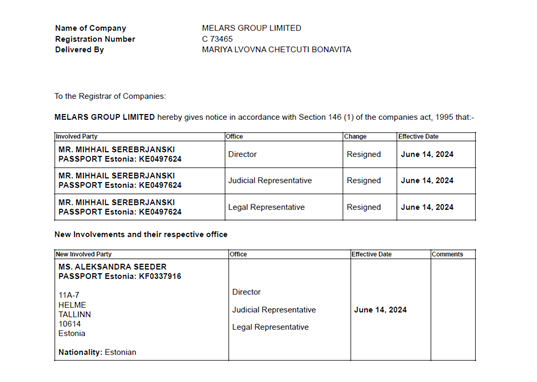

We also note that Seeder took over the management of Melars after Mihhail Serebrjanski, a professional nominee and an ethnic Russian from Estonia, who, based on his social media activity, holds strongly articulated pro-Russian views. The employee managing Melars in Malta is another Russian—Mariya Lvovna Chetcuti Bonavita. Despite her last name, her social media name, Masha, and her patronymic, Lvovna, clearly indicate her Russian origin.

Picture 3. Aleksandra Seeder appointment.

Trivette OU: A Baltic Entity with a Russian Tint

The second shareholder in Melars Group Limited, the Estonian company Trivette OU, presents an equally enigmatic profile. Registered on December 7, 2006, in Tallinn, Trivette operates within the logistics and transportation sector, mirroring Melars’ stated activities. However, a deeper analysis of its ownership, past directors, and connections raises critical questions about its purpose and affiliations.

A Shared Web of Influence

Trivette OU’s sole owner is Dmitry Palivoda, a key player who also serves as a director and legal representative for Melars. Palivoda’s role in both entities establishes a direct operational link, reinforced by overlapping personnel and historical ties between the two companies. For instance, Melars itself held a 100% stake in Trivette OU from 2007 to 2008, and Dmitry Kovalenko, the majority shareholder of Melars, also briefly co-owned Trivette. This pattern suggests a deliberate integration of business interests between the two entities.

Much like his counterpart Dmitry Kovalenko, Dmitry Palivoda maintains a strikingly low profile in public records and media. His role as Trivette OU’s sole owner places him at the heart of its operations, yet little is known about his broader business dealings. Court documents reveal that Palivoda has represented Melars in legal disputes, indicating his operational involvement extends beyond Trivette.

The lack of transparency surrounding Palivoda’s activities raises critical questions. Palivoda’s role as a “trading agent” for Melars during its earlier years underscores his active engagement in managing the company’s logistics and commercial interests.

Trivette OU’s early ownership by Larssen Capital, a now-defunct Estonian consultancy, adds another layer to its narrative. While no direct connections to Russian government or sanctioned individuals have been established, Larssen Capital’s previous involvement and Trivette’s operational alignment with Melars suggest a network designed to facilitate cross-border business in potentially sensitive jurisdictions.

Moreover, Trivette’s registered address overlaps with other entities in the Kovalenko-Palivoda network, reflecting a shared infrastructure that could serve as a strategic hub for managing interconnected business interests. This setup is reminiscent of tactics used by entities navigating regulatory scrutiny in high-risk sectors.

Levantes Management Limited: A Bridge to Sanctioned Cypriot Networks

Levantes Management Limited once held a stake in Melars Group Limited, though the timeline and specific nature of its involvement remain opaque. What is clear, however, is Levantes’ entanglement with Cypriot companies that have since been sanctioned by Ukraine. These Cypriot firms include Kamaronian Investments Limited and Notrosion Management Limited, both flagged for their ties to Russian economic interests. Although Levantes itself has avoided direct sanctions, its association with these entities casts a shadow over its operations.

Adding to the intrigue are the directors of Levantes, several of whom are Cypriot nationals linked to sanctioned or suspicious entities. Notably, one director, Sofoclis Papavarnavas, is currently on Ukraine’s sanctions list due to his involvement with companies reportedly under Russian influence. Reportedly, Papavarnavas has been associated with entities like Rosemead Enterprises Limited, which once held significant sway over Russian financial institutions, including Bank Zenit.

Cyprus as a Conduit for Russian Interests

Cyprus has long been a hub for Russian-linked businesses seeking favorable tax regimes and relative anonymity. Levantes’ connection to Cypriot companies under sanctions fits into this broader pattern of utilizing Cyprus as a strategic waypoint for financial and corporate activities. Another Levantes director, Paraskevi Maltezou, also has a history of affiliations with Russian companies. Although details are sparse, records indicate past involvement with Uralsantekhmontazh, a Russian industrial entity. These connections, while indirect, suggest a recurring theme of Russian influence within Levantes’ orbit.

In addition, Maltezou has apparently been representing the interests of another sanctioned Russian oligarch—Vladimir Melnichenko from Sibuglmet.

The affiliation of Levantes Management Limited with Melars, coupled with its directors’ ties to Cypriot companies and potentially to Russian oligarchs under Ukrainian sanctions, raises serious concerns about the transparency and legality of Melars’ past operations. And what if the current operations are simply better camouflaged? That remains an open question.

Money Laundering and International Sanctions

A closer look at Jan Harm Snyman, the secretary of Melars Group Limited, reveals yet another layer of complexity and raises questions about the company’s connections and operational transparency. While no direct evidence links Snyman to illicit activities, his background and familial associations contribute to the growing cloud of suspicion surrounding Melars’ network.

Jan Harm Snyman’s role as Melars’ secretary positions him as a key administrative figure. However, his professional footprint extends far beyond this role. Public records indicate that Snyman is involved with five other Maltese companies, though none appear directly linked to Melars. He also holds positions in several British entities, connecting him to a wide range of jurisdictions including Cyprus, Seychelles, South Africa, and Ukraine.

Jan Harm Snyman is reportedly related to Joanna Elizabeth Snyman, who has been implicated in activities related to money laundering aimed at circumventing British sanctions on Russia. Joanna Snyman is associated with a British company suspected of being part of a network designed to funnel funds linked to Russian interests, bypassing international restrictions. Both Jan Harm and Joanna share a South African residential address, strengthening the likelihood of familial ties.

While no direct evidence ties Jan Harm Snyman or Melars Group Limited to Joanna’s alleged money-laundering activities, the proximity of these associations coupled —combined with all other red flags— is difficult to ignore. The shared connections to South Africa and Malta—jurisdictions with histories of opaque financial practices—underscore potential vulnerabilities in Melars’ governance.

Snyman’s multifaceted corporate roles and his connection to an individual under scrutiny for sanctions violations fit within a broader pattern of opacity observed in Melars’ operations. This deliberate lack of clarity, combined with overlapping affiliations, makes it challenging to discern the true scope of Melars’ activities. Whether these connections are coincidental or strategic, they contribute to the mounting questions surrounding the company.

Legal Representatives and Links to Russian Business

The legal proceeds involving Melars Group Limited reveal connections to influential figures with direct ties to Russian state-affiliated businesses.

In 2015, during a legal dispute against Integral Petroleum SA, Melars Group Limited enlisted the services of Daniel Richard, a prominent Swiss lawyer. At the time, Richard was associated with Prlex Avocats, a Geneva-based legal firm, and was a recognized expert in international corporate law. His role in the case, however, extends beyond ordinary legal representation.

Richard’s legal practice has historically focused on complex corporate structures, advising clients on international operations, asset management, and dispute resolution. According to public records, his portfolio includes managing roles in over 30 Swiss companies, as well as membership in prestigious legal associations such as the International Bar Association.

Prior to his work with Melars, Richard held executive positions in Rosneft Trading S.A. and Rosneft Overseas S.A., both subsidiaries of the Russian state-controlled oil giant Rosneft. These entities have played pivotal roles in Rosneft’s global operations, often operating in sensitive markets. Richard’s tenure at these subsidiaries indicates a close professional alignment with Russian state interests, even if his involvement with Rosneft ended before the Melars case.

The choice of Richard as legal counsel reflects not only on Melars but also on the broader ecosystem of professionals who facilitate international corporate operations. Lawyers like Richard, with deep ties to Russian-affiliated businesses, often operate at the intersection of legality and geopolitical sensitivity. While their involvement does not inherently indicate wrongdoing, it raises questions about the motivations and alliances behind their selection.

Should Melars Group’s Operations Face Greater Scrutiny?

Melars Group Limited and its owners exhibit a series of indicators suggesting potential links to Russian interests and sanctioned individuals. The intricate network of overlapping ownerships and roles across its associated entities—including Trivette OU and Levantes Management Limited —raises questions about the transparency of its operations. The company’s key figures, Dmitry Kovalenko and Dmitry Palivoda, maintain low public profiles, yet their business activities point to a coordinated structure, potentially designed to obscure the true nature of their dealings.

Further, historical affiliations with legal representatives such as Daniel Richard, who has held senior positions in subsidiaries of the Russian oil giant Rosneft, as well as familial links to figures implicated in sanctions violations, add to the growing concerns. While no direct evidence ties Melars to illegal activities, the recurring connections to individuals and entities with Russian affiliations highlight the need for greater scrutiny.

The close ties between Melars Group’s trading operations and the extreme discretion maintained by Dmitry Kovalenko cannot be overlooked. His indirect involvement in the real estate sector through proxies further raises questions. While we do not claim to have definitive evidence—nor is it our role to uncover it—our years of investigating international fraud and money laundering allow us to recognize familiar patterns. One of the most favored investment channels for money launderers worldwide remains real estate, and the recurring elements in this case warrant serious consideration.

The overall opacity of Melars’ governance, combined with its web of international entities and affiliations, situates it within a broader pattern of businesses that operate in high-risk environments while maintaining limited public accountability.

If you have any information about Melars Group or the companies/individuals associated with them, please contact us at support@researchinitiative.org. Your input could greatly assist our ongoing investigation.

Our thanks go to the team at https://AssetTracing.com for their assistance in preparing this investigation

© 2024 ResearchInitiative.org All rights reserved. This publication may not be reproduced, distributed, or transmitted in any form or by any means, including photocopying, recording, or other electronic or mechanical methods, without the prior written permission of the ResearchInitiative, except in the case of brief quotations embodied in critical reviews and certain other non-commercial uses permitted by copyright law.